As bitcoin dominance continues in the ‘crypto’ market, many are trying to acquire as much as possible. Now, there are mainly 3 ways to acquire bitcoin (or Sats) i.e. mining, buying and earning. In this GoSats guide, we will talk about the ‘earning’ part and mainly earning bitcoin (BTC) or even Gold for ‘free’ in a totally legal way.

1 Bitcoin = 100 Million Sats

The easiest & efficient way to ‘earn’ bitcoin for free in India that I could find is through GoSats. Even before I begin with this, am in no way getting paid by anyone for writing this. Am just a regular GoSats user who loves the product. And another big reason is that they’re are a ‘bitcoin-only’ company thus no other VC-backed/pumped crypto tokens are involved.

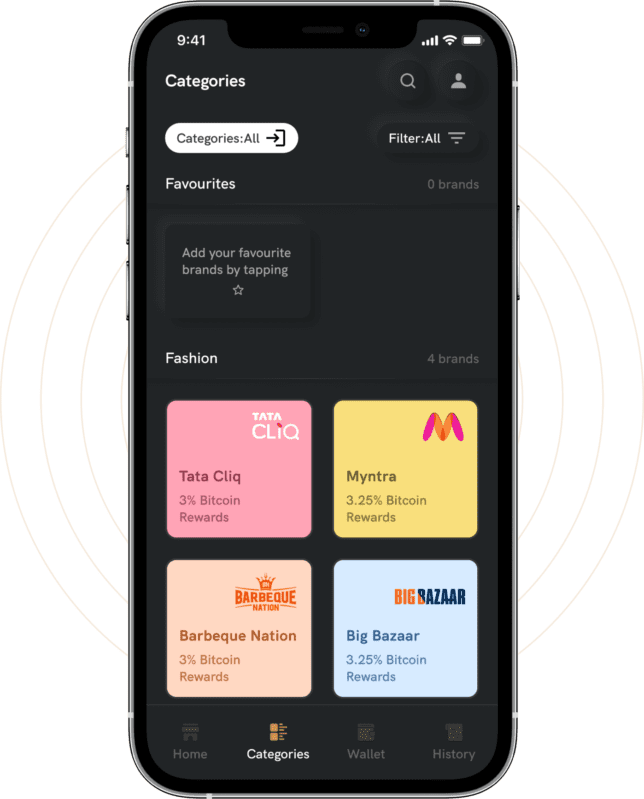

Now let’s begin – So what’s GoSats? The dumb answer to it is – It’s basically an app for both android & iOS. And you get free cashback in Sats (BTC) or Gold whenever you buy something online or offline. Yes, you can buy stuff from your local mall & still get cashback in your GoSats app. It’s on you to decide in what form you want the cashback in – Gold or Bitcoin (Sats)

First, download the app from here – GoSats.io. Not at all mandatory, but you can use my referral code GSGC9190 during signup. On doing so you may get extra joining bonus Sats or Gold for free without any extra cost to you and it also helps me run this website for free without even any ads or privacy invasive data trackers. Anyway, if you used my referral code – thanks. I really appreciate your support 🙏

So, there are two ways to use the app & stack Sats or Gold for free

- Voucher (Gift Card)

- GoSats Card

Voucher

Whenever you buy something online on sites like Flipkart, Myntra, Zomato, etc. you can use this feature.

How to Use?

Step 1: Calculate the total cost of your purchase. Let’s say you want to buy XYZ for ₹1000 on Zepto.

Step 2: From GoSats App, choose ‘Zepto’ brand & buy ₹1000 worth of Voucher (Gift Card). You will receive a ‘Voucher Code’ and a ‘Voucher Pin’ inside the GoSats app’s ‘History’ tab.

Step 3: Go back to Zepto & during checkout choose ‘Gift Card’ option to pay for your purchase.

Step 4: Enter the Voucher Code & Pin, and order XYZ.

That’s it. You will receive cashback in sats or gold (whichever you’ve selected) in your GoSats app without any extra cost to you. If BTC/INR value goes up, your Sats value stored in the GoSats app will go up too. Also, you can follow these above steps for not only Zepto but any sites/app/brand whose vouchers are available inside the GoSats ‘Brands’ tab.

GoSats Card

Whenever you buy something online or offline, you can use this feature. This is what I mostly use.

Getting the card is very simple, from inside the GoSats app you have to order an ‘Intro’ or ‘Elite’ card. It asks for KYC, and once done – the card will be delivered to your address within 15 days. You can additionally do Video-KYC (which is also very simple) to increase your card limit.

Just like any other debit card, you can use it to purchase anything from anywhere i.e. both online websites and offline stores without any hidden charges. Its a VISA Card issued by IDFC Bank. The only difference with a pure debit card is that this GoSats Card kinda acts like a wallet i.e. it’s not directly linked to your bank account rather you have to top up your GoSats Card.

For Example: If you know that you purchase ₹15,000 worth of stuff each month online & offline, then starting each month fill (top up) your GoSats Intro or Elite Card with ₹15,000 and then keep using it until it’s finished. Then top up again through the GoSats app itself – it’s very simple, quick & free.

Which card to choose? I personally have both. And I tend to use the ‘Elite Card’ more due to the higher reward/cashback percentage. Earlier Elite Card had a yearly fee, which is now removed. It just has one time fee with no hidden charges so Elite Card looks really attractive now.

Don’t click on random links to signup for GoSats app. You may get scammed through fake/phishing links. You can signup from here – GoSats.io. Not mandatory at all, but will be really grateful if you use my referral code GSGC9190 during signup.

Conclusion

GoSats Card is kind of an automated SIP in bitcoin or gold for me. It’s like whenever I purchase something, I additionally buy a little bit of bitcoin (sats) for no extra cost & effort from my side. And I can later withdraw the BTC (to my personal wallet) from the GoSats app.

For me, debit cards don’t give anything in return, and most credit card points are kinda worthless as I don’t spend that much monthly so I can’t accumulate enough points to convert it into something useful. Also, credit card points have a time limit & then it expires if I don’t use them. So I personally prefer the GoSats Card over most debit or credit cards.

- Again, I am in no way getting paid to write this piece. I don’t have any equity in the company, nor I am anyway involved with their operations. Am just a user like you.

- You can use your accumulated Sats (instead of INR) for purchasing different vouchers inside the app.

- Or you can withdraw your Sats (Bitcoin) every 5 to 6 months.

- If you withdraw, you should store those Sats (BTC) in your personal / self-custodial wallet. I explained that process – click here.

As always please don’t take this as investment advice; am not a SEBI-registered investment advisor. You should do your own research. This is just a one-to-one talk about helping and motivating you to start your investment journey as fast and with as little money as possible.

Never forget, Save Invest Repeat is our life mantra.

If you have any questions or feedback, send them at @InvestRepeat. Also, you can join my private Telegram channel (Username: InvestRepeat).

Your man,

SIR