When I say ‘Best Portfolio in India’, what I mean is the best suitable portfolio for me in India. But this portfolio allocation can easily be replicated in any country by anyone.

Every December I rebalance my portfolio depending on the current situation and my future projections. So this year I am doing the same and sharing it with you – maybe this could help you build your portfolio.

My goal for 2021 is to take maximum risks and make those moves that I strongly believe in. As always I make all my moves – keeping “long-term time horizon” in mind. I want to be on the right side of compound interest and not be against it.

I always divide my portfolio into two parts – Safe Fund and Risk Fund. First, let’s go through my 2020 i.e. current portfolio

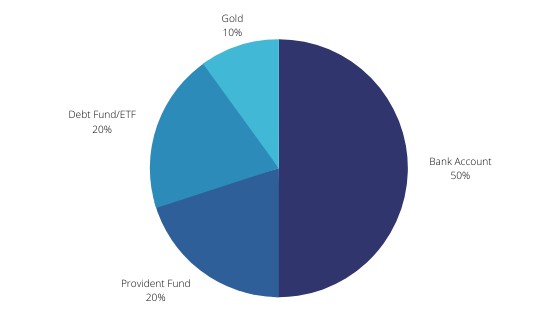

My 2020 Portfolio

In 2020, my portfolio was divided into – 20% Safe Fund and 80% Risk Fund. It gave me an approximate return of 93% as compared to Nifty 50’s 12%. Now let’s get into the details

Safe Fund

Risk Fund

ETF, Index/Mutual Fund Division

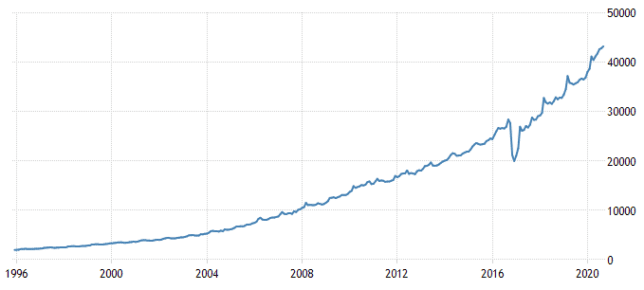

My top 3 performing investments were – Bitcoin (BTC), Stocks and Gold. And among stocks, my top 3 performers were IOLCP (+171%), GRANULES (+129%) and INFY (+77%). My only two losers were ITC (-32%) and FIEMIND (-7%). When I say loser it doesn’t mean I have lost interest in these stocks, what I mean is that they were losers just in 2020.

My 8 Future Predictions

1. Work from Home: Most of the talented employees I talk to have planned to work from home (WFH) in the coming years. So companies that do not want to lose this talent pool will allow almost everyone to WFH. Thus, Residential real estate and rental market will be in serious trouble. Though traveling and luxury rental market will boom.

2. Banks: This is the last decade of existence of big banks. Fintech and DeFi will kill all traditional banks. And as I always say – banks are required, bankers are not. So people preparing for banking exams rather than learning to code – good luck.

3. Money Printing: All central banks will have to print more money to satisfy their government’s debt. In the current situation, interest rates will go near 0% for most economies and some will go to negative rates too. All these points to one thing: Our fiat currency ($ or ₹) is almost worthless. Also, keep this in the back of your mind – 51 out of 52 times a country’s Debt-to-GDP ratio reached 130%, the country eventually defaulted. USA is now at 136%.

4. Privatisation: Current government’s privatisation effort will unlock huge potential in many PSUs. This is a positive step to make government divisions like Railways more efficient and profitable.

5. Reforms: Politics aside, the current reforms are extremely positive for the long term. It will remove the “License Raj” and the unnecessary government middle man, thus reducing corruption. Thus making India more attractive for FDI (Foreign Direct Investment).

6. Bubble: Stock Market is a bubble, Bitcoin is a bubble, tech stocks are in a bubble etc. It is now a fashion to say everything going up to be a bubble. I do not think any of those are right. In today’s world, nobody knows anything. And as it is famously said – If you are not in a bubble, find one.

7. Asia: In the upcoming decade, world’s economic center will shift from US/EU to China/India.

8. India: Due to large amount of cheap labor, immense vacant land, low corporate taxes, pro-business government, low oil price (USD), stable rupees (₹) and anti-china sentiments – India will be at the forefront of Asia.

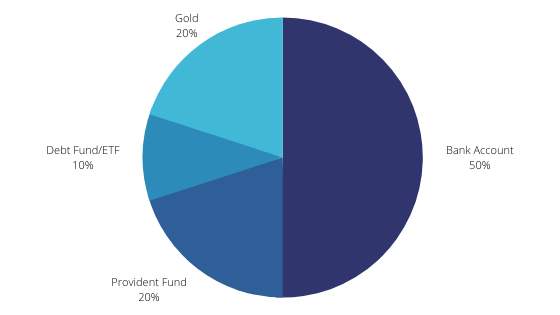

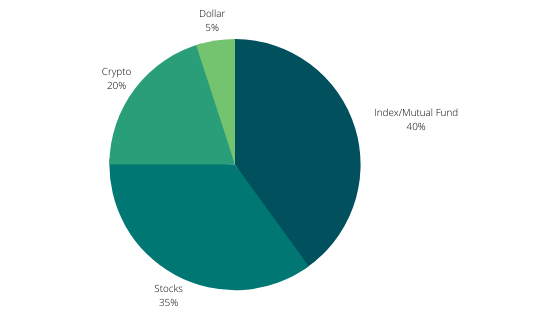

My 2021 Portfolio

In 2021, my portfolio will stay same – 20% Safe Fund and 80% Risk Fund. But as previously said, I will take maximum risks and for that, I will make significant changes in my safe and risk fund allocation. Here are the details

Safe Fund

Risk Fund

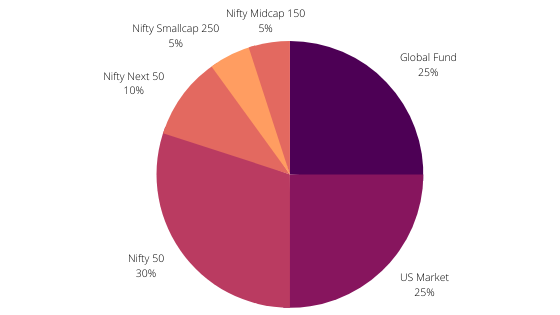

ETF, Index/Mutual Fund Division

In the coming year, my aim will be to make my portfolio more concentrated in accordance with my 8 future projections and shift from Index Funds to ETFs.

In Safe Fund, I will increase my Gold & Silver exposure and decrease Debt fund/ETF exposure. This mainly because of unlimited money printing which has almost destroyed the bond & credit market and will keep inflation high. Every time this happens gold & silver benefit from it.

In Risk Fund, I will increase by Bitcoin holding & may enter Ethereum too (still researching); and decrease almost all other holdings. The current macro-economic situation and the BTC chart suggest that this is going to be once in a lifetime opportunity. And specifically in Index Funds and ETFs – am reducing the number of holdings to make the overall portfolio less diversified & more concentrated.

As always, please don’t take this as investment advice; am in no way a certified investment advisor. This is just to share my personal portfolio and thoughts about 2021.

If you have any questions, post them at @InvestRepeat. Also, you can join my private Telegram channel (Username: InvestRepeat).

Your man,

SIR